If you own an investment property, or you’re looking at purchasing one, you’re probably wondering whether you need a property manager or if you can save some money by handling it on your own. But the truth is, self-managing your investment property can end up costing you more than hiring someone who knows what to

Search Results for:

*Disclaimer: The information in all of our articles is of a general nature only and should not be relied upon as advice. You should seek professional advice for your particular circumstances before entering into any transaction.

As a tenant you may be obligated to contribute to the water consumption of the property you are renting. Lessors are able to pass on the full water consumption charges to tenants if: the rental premises are individually metered (or water is delivered by vehicle), and the rental premises are water efficient, and the tenancy

Our longevity lies in our over 18 years’ experience in Brisbane property management. Here’s our 5 secrets to property management success and why you should choose Position One Property as YOUR property manager. Number 5 – Our team conduct open homes This may seem like a no brainer, right? Many property management agencies have

When a tenancy ends the first thing a tenant usually wants to know is, how do I get my bond back? As a tenant you must to do a “bond clean” or “exit clean” at the end of your lease. A bond clean or exit inspection clean is the clean that must be done

Climate change is becoming an ever-prevalent concern in today’s society. This concern is leading some home owners to invest in solar panels. But, do solar panels increase property value? Do solar panels increase property value? A realestate.com.au survey found that 85% of people believed that solar panels added value to a property with 78 per

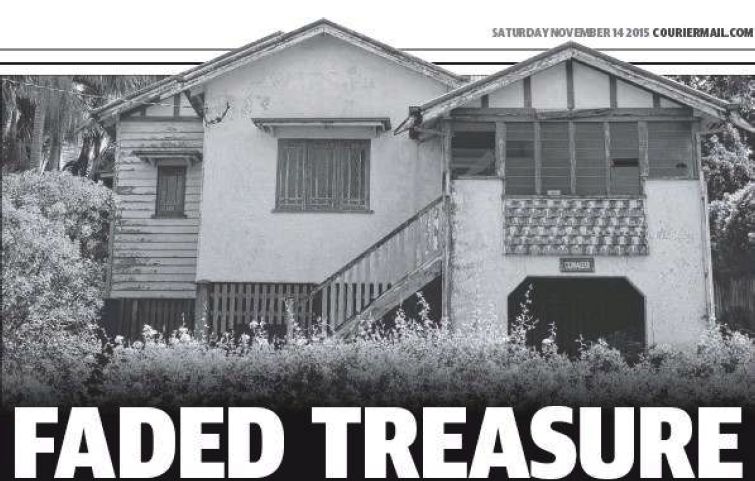

This week is a personal story of struggle and survival, of hardship and pain of the trials and tribulations of buying a renovator’s delight. But, without the word delight attached to it. Let me start from the beginning. It was a rainy day and I took my youngest daughter to swimming lessons. My husband went

In 2017 new legislation came into effect in Queensland requiring all smoke alarms in rental proprieties Qld to be photoelectric by 2022. Photoelectric smoke alarms detect visible particles of combustion. They respond to a wide range of fires, but are particularly responsive to smoldering fires and dense smoke. Changes to the smoke alarm legislation will impact

Do you want to experience better property management? Yes? … Read on…….. Position One Property pride itself on providing premium real estate property management in Brisbane at an affordable price. We listen to our owners and their concerns and provide constructive feedback, when required. Our team find quality tenants for your property and take the

With tax time just around the corner it is time to look at investment property tax deductions. When buying an investment property make sure you seek advice and know what investment property tax deductions you can claim. Put simply investment property tax deductions entail 1) management and maintenance costs and 2) borrowing expenses. Management and maintenance

As a property investor not only do you want quality property management, you also want value for money. This is why some property investors look for flat fee property management. In this article we will look at the disadvantages of flat fee property management. We will also analyse the negative impact it can have for you as